What Do You Need To Open A Bank Account: A Full Guide 2025

If you’re new to New Zealand, or looking for better ways to manage your finances in NZD, getting a bank account is pretty much essential. Maybe you’re moving to New Zealand to work or study, opening a New Zealand business, or a regular visitor who needs ways to hold, receive, send and spend dollars easily.

Opening a New Zealand bank account should be pretty easy as long as you have all the right documents to hand. This guide walks through everything you normally need to open a bank account in New Zealand, plus we’ll look at some alternatives like Wise and OFX which offer online accounts you can open from all over the world.

Table of Contents

- What do you need to open a bank account online?

- How to open a bank account in New Zealand?

- How much does it cost to open a bank account?

- Can you open a business bank account online?

- What do you need to open a bank account if you’re under 18

What documentation do you need to open a bank account?

Exactly what’s needed to open a bank account in New Zealand may vary a little depending on the account type you pick, and the bank or provider you want to use. There are also some variances based on your own personal situation – for example, if you’re a US citizen or a US resident you may need some extra details and documents to get started.

All that said, as all New Zealand banks must comply with the same local and global financial regulations, the documents required tend to be fairly similar.

Here are the documents you’ll need to be able to open a bank account:

- Valid proof of identity – usually a government issued photo ID

- Valid proof of address – traditional banks usually require a local New Zealand address

- Proof of meeting any other eligibility criteria – proof of student status for a student account, for example

Identification documents usually accepted when opening a New Zealand bank account include:

- A full and valid New Zealand or foreign passport – plus a visa if you’re not a New Zealand citizen

- New Zealand refugee or emergency travel document

- A full New Zealand driving licence

- New Zealand firearms licence

Proof of address documents usually accepted when opening a New Zealand bank account include:

- A recent bank statement showing a New Zealand address – digital bank statements are not accepted

- A recent New Zealand credit card statement or utility bill

- Government correspondence showing your name and address

Other options can include a mortgage statement or tenancy agreement – and if you don’t have any of the suggested documents, some banks can consider alternatives if you call them directly.

Related:

Save the paperwork with online solutions like Wise and OFX

As you can see, the documents required by traditional New Zealand banks may be tricky to find if you’re new to the country or simply don’t have bills in your name. If you don’t have the standard documents suggested, the chances are that you’ll need to visit a branch to get your account opened – which can be time consuming and inconvenient.

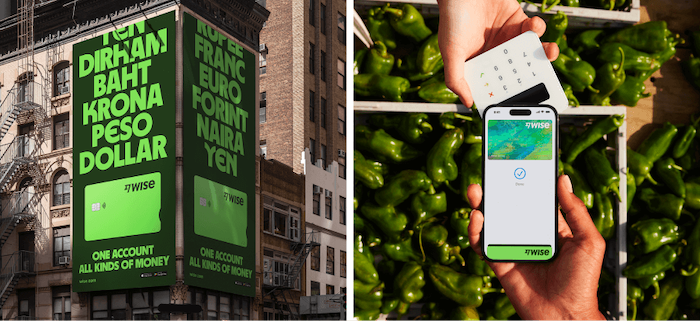

As an alternative, check out digital providers like Wise and OFX, which offer a fully online onboarding and verification process. All you’ll need to do is register an account online or through an app, and upload images of your documents, which can often be verified instantly – or at least pretty quickly, so you can start using your account.

Online providers like Wise and OFX are also often able to accept proof of address documents from a good range of countries, which can be easier if you’ve just arrived in New Zealand or if you’re trying to get your account set up before moving. Just use your normal home proof of ID and address, and access an account which can be used to hold, send and exchange New Zealand dollars, even before you get settled in your new home.

Learn more about Wise

What do you need to open a bank account online?

Some New Zealand banks allow customers to open a bank account online or through their apps. However, this is only usually possible if you have standard ID and address documents – and may still require you to visit a branch, make a call, or complete other checks like recording a short video to prove you’re really who you say you are.

Alternative providers like Wise and OFX allow customers to open a bank account completely online or in an intuitive app, which can be a smooth – and sometimes even instant – process.

Here is what you’ll usually need to open an account online with a traditional New Zealand bank:

- Proof of ID – a passport or a New Zealand driving licence for example

- Proof of address – a bank statement or utility bill in your name for example

Alternative providers may have more flexible ways to apply for an account online or through an app, usually requiring customers to upload one or two documents, and take a selfie. Why not consider Wise and OFX:

Wise Account: Open an account online or in the Wiseapp, to hold and exchange 50+ currencies, and get a linked payment card for spending and withdrawals in 170+ countries. Wiseaccounts come with local bank details for 10 currencies to receive fee free payments conveniently from 30+ countries.

Click here to read a full Wise review

OFX Global Currency Account: Business owners and online sellers can open an OFX Global Currency Account to hold and exchange 7 currencies, and get paid from customers, marketplace sites and platforms easily. You’ll be able to make payments from your account in 50+ currencies, access currency risk management products, and talk to a broker by phone 24/7.

Click here to read a full OFX review

How to open a bank account in New Zealand?

Let’s walk through the steps to open a bank account in New Zealand. The exact process you follow may vary a little depending on the bank and specific account you pick – but here’s a handy overview to build a picture:

- Choose a bank or a provider to open an account with: account features and fees vary widely, so picking the right one for you will require a bit of research. Look at a mix of big highstreet bank brands and more modern alternatives, to find the right match for you.

- Make sure that you’re eligible to open an account with them: different accounts have their own eligibility criteria, which may include a credit check, minimum salary or deposit requirements, or proof of student or employment status.

- Choose the right account for yourself: by comparing a few different accounts you can find one which offers the services you need, conveniently – and with low fees for the transactions you make frequently.

- Put the required documentation together: standard bank accounts require you to have several documents to get started – make sure you know what your preferred provider needs, and have everything to hand before you start your application.

- Apply to open an account: finally you can make your application – online, in app, by phone or in a branch. You’ll get your account paperwork and card in person, or through the post a little later, depending on how you apply.

Read here a complete guide on how to open a checking account.

Everyday vs savings accounts

Everyday accounts are normally used for day to day transactions and spending. They’re designed to make it easy to receive and spend, with linked debit cards and online and mobile banking options.

Savings accounts are usually aimed at people trying to build a nest egg – with higher interest rates, and sometimes more restrictive conditions. You may find you can only make a limited number of withdrawals – or even no withdrawals at all – if you want to continue to earn interest on your deposit.

| Everyday Accounts might be best: | Savings Accounts might be best: |

|---|---|

|

|

It’s worth remembering that even if you can’t open an everyday or savings account with a regular New Zealand bank, you can still consider online alternatives such as Wise and OFX. Wise offers flexible account options for personal and business customers, which come with easy ways to hold, spend and exchange New Zealand dollars – and a selection of other currencies – with linked payment cards and other handy features. If you’re a business owner or online seller you can also consider OFX, to get paid in 7 currencies and hold and exchange between them easily online and in-app.

What to look for when choosing a bank account

You’re spoiled for choice when it comes to New Zealand bank accounts. However, that does mean you’ll have to invest some time in picking the right one for you. Here are some pointers to consider:

- Account fees: Some New Zealand accounts have no monthly fees, but transaction and service fees will usually still apply. Compare these carefully for the transactions you make often, to keep overall costs down

- ATM availability: If you’ll be withdrawing regularly, check where you can get local fee free ATM services, and the costs for out of network and international withdrawals too. Regular banks usually have fairly high international ATM fees – alternatives like Wise have some fee free international withdrawals to keep costs down

- Online banking: Most banks offer online and in-app banking – check that the service you’re looking at is intuitive and offers the transactions you need to make online

- Debit cards: Contactless debit cards which offer mobile payments are quite common in New Zealand now – make sure you get a card you can use easily for the payments you’ll need to make

- International transactions: Finally, check the fees when you spend or send foreign currencies – these can be pretty high with traditional banks – but specialist services like Wise and OFX can often provide better exchange rates and more transparent fees

How much does it cost to open a bank account?

Basic bank accounts in New Zealand are usually free to open – but some banks will ask you to make a minimum deposit amount to get started. This can be just a few dollars for simple accounts – but for premium tier accounts, you may be asked to deposit or invest a pretty staggering amount.

Specialist account services can be a cheaper alternative – for example, open your Wise Account of OFX Global Currency Account for free, with no minimum deposit and no monthly fee to pay.

What documents do you need to open a business bank account?

Business bank accounts are essential as soon as you start to make or receive payments on behalf of your company. Even if you’re not legally obliged to have a business bank account – as a freelancer or sole trader for example, they can be a smart way to manage your personal and business finances efficiently.

To open a New Zealand business bank account you need:

- Proof of identity – such as a passport or driving licence

- Proof of address – like a utilities bill or bank statement

- Business documentation – varied by business entity type, including a Certificate of Incorporation for example

It’s very common to need to visit a branch of a traditional bank if you’re looking for a business account. Alternative online services like Wise and OFX can offer business accounts to New Zealand registered companies and freelancers – which can be opened online, with no or low fees, and great multi-currency functionality to allow you to expand your business internationally.

Can you open a business bank account online?

Some banks allow business customers to open accounts online, but this is dependent on the business entity type you have, and the bank you select. In some cases you can only open a business bank account online if you already bank with the same institution.

That probably means that new customers will have to make a branch visit to get everything sorted and receive your account paperwork and cards.

What documents do you need to open a business account online

You’re most likely to be able to open a business bank account with a traditional bank online if you’re a sole trader, and you’re already registered with the bank you’re opening an account with. More complex business entity structures and new customers are often not offered online opening functions. Check with the bank you prefer directly before you get started.

On the other hand, specialist online providers like Wise and OFX offer online account opening options to all business customers, and can be a handy alternative.

To open a business account online with a traditional bank, you need these documents:

- Proof of identity

- Proof of address

- Business documentation – varied by business entity type

Not sure about traditional banks vs online specialist business accounts? Check out the Wise Business Account and the OFX Global Currency Account as a comparison:

Wise Business Account: open online or in app with a one time low fee and no ongoing charges or minimum balance requirements, hold 50+ currencies, get local bank details for 10 currencies, and order debit and expense cards for you and your team. Account holders can add and manage user permissions, and access handy perks like batch payments and Xero integration.

OFX Global Currency Account: free to open, hold and exchange 7 currencies, with easy ways to get paid from customers, marketplace sites and platforms. Send payments from your account to suppliers and staff in 50+ currencies, access currency risk management products like limit orders and forward exchange contracts, and talk to a broker by phone 24/7.

What do you need to open a bank account if you are under 18

Most major New Zealand banks offer bank accounts for minors under the age of 18.

The basic requirements to open a bank account for a minor are similar to those for an adult – but there’s usually more flexibility in how verification processes work.

To open a standard bank account as a minor you’ll need:

- Proof of ID – a passport, driving licence or birth certificate for example

- Proof of address – contact your bank directly to discuss the options available, based on the customer’s age

Conclusion

Opening a New Zealand bank account isn’t hard as long as you have all the right paperwork to hand. However, if you don’t have the suggested documents as proof of ID and address you might find the process is harder – and you’ll often need to go to a branch to get started.

Online and digital account specialists can often provide a more intuitive account opening experience, with faster services and feature packed accounts as a bonus. Check out Wise if you want an account you can open online or in-app, to hold and exchange dozens of currencies, with easy ways to send, spend, receive and manage your money. Or if you’re a business owner looking for an account with a 24/7 phone service, try OFX – the Global Currency Account can hold and exchange 7 currencies, for easy ways to get paid through online sales, marketplace sites and platforms.

FAQs – What info do you need to open a bank account?

Which banks allow you to open an account online?

If you have a full set of standard documents, including proof of ID and a New Zealand address, you can open an account online with a major bank like Westpac or ANZ. However, you might find it’s an easier and faster process with a specialist service like Wise and OFX.

How much money do you need to open an account?

Some traditional banks will ask you to make a minimum opening deposit, which could be a fairly low amount for a standard account – or much higher if you’re looking for a premium tier account product. Take a look at online specialists like Wise and OFX if you want an account with no minimum deposit and an easy online onboarding.

Do I need to go to a bank to open an everyday account?

You might be able to open an everyday account with a regular bank if you have a local New Zealand proof of address and a standard ID document. If not – or if you want an account which comes with great international features – check out digital services like Wise and OFX for easy online and in-app application processes and smart account products which can help you to save money.

Which bank is easiest to open an account with?

There’s no single easiest or best bank – it’ll all depend on the specific account you want, and which documents you’ve got for verification. Compare a few and don’t forget to check out Wise and OFX for accounts that can be opened online, fast, conveniently for free.

Can a minor open a bank account without a parent?

Older teens in New Zealand can open some bank accounts as long as they have a proof of ID and address. Younger teens who may not have all the required documents may still be able to open an account, but they’ll need to talk to their preferred bank directly to check which documents are recommended in their specific circumstance.