Best multi currency cards: What are the best options in New Zealand? 2025

Spending and making cash withdrawals when you travel abroad can mean extra fees compared to using your normal payment card in New Zealand. Extra costs can also apply whenever you spend in a foreign currency online. Charges may include a separate foreign transaction fee, international ATM fees and more.

A multi-currency payment card may allow you to get a better exchange rate, and avoid foreign transaction fees so your overseas spending costs less in the end. This guide walks through all you need to know, including the benefits of a multi-currency card from non-bank alternatives like Wise and Revolut, so you can see how they measure up against using your bank card when you’re on holiday.

Multi currency cards: the best options in New Zealand

We’ll walk through our picks for New Zealand multi-currency cards in more detail in a moment, so you can see if any may suit you. First, let’s get an overview of the cards we’ll introduce and their features.

| Multi-currency card | Best features |

|---|---|

| Wise card

|

|

| Revolut card

|

|

| Travelex Travel Money Card

|

|

| Mastercard Cash Passport

|

|

| Air New Zealand Onesmart Card

|

|

How do multi currency cards work?

A multi-currency card lets you pay for things in foreign currencies while you’re abroad, or when you’re shopping online with retailers based overseas. You’ll usually be able to add a balance in either the foreign currency you need in your destination, or in NZD, and then use your card to spend online, or make contactless payments and cash withdrawals as you would any other payment card.

How does a multi currency card work?

You can use a multi-currency card in pretty much the same way you can any other debit card. However, multi-currency cards are optimised for international use, and usually let you hold a balance in foreign currencies, so you can pay without hitting any foreign transaction fees.

As with other debit cards, when you spend with a multi-currency card, your spending will be immediately deducted from the balance of your card. That means you’ll need to add money before you can start spending – usually to a digital multi-currency account you can manage from your laptop or phone. The main difference with a multi-currency card compared to a debit card is that you’ll get it from a non-bank provider, and you can add money in a range of currencies for convenient overseas spending. With the Wise card, as an example, you can hold 40+ currencies, with no fee to spend any currency you hold in your account. That can keep costs down when you travel and shop online with international retailers.

How can I use a multi currency debit card abroad

You can use your multi-currency debit card overseas, more or less anywhere the card’s network is accepted. Most multi-currency cards in New Zealand are issued on either Visa or Mastercard networks which are globally accepted. The only normal limitation it’s good to know about is that you’ll probably not be able to use your multi-currency card where a payment guarantee is needed – when you hire a car, get fuel from a pay-at-pump station, or check into a hotel for example.

Once you have your multi-currency card you can usually use it to make contactless payments, add it to a wallet like Apple Pay, or to make cash withdrawals at home and abroad.

How to request a multi currency debit card

Most multi-currency debit cards in New Zealand come from non-bank providers which operate primarily online. Some are from non-bank services with a branch network, like Travelex.

In all cases you can order your multi-currency card online or through an app in just a few steps. If you’ve selected a card from a provider with a physical location you may also be able to call into a branch with an ID document, and get a card instantly.

Getting a multi-currency card online or in an app is usually the most convenient option. As an example, how to open a Wise account and get a Wise card step by step:

- Visit the Wise website or app and click on Create account

- Enter your email address

- Follow the prompts to enter your personal and contact information

- Create your password for security, and get verified

- Within the app, go to the cards tab and select Order card

You’ll be prompted to add some documents to verify your identity and address. This can be done digitally, and should be as simple as taking a photo of your passport or driving licence, and a proof of address, with your phone and uploading the image.

What are the transaction fees applied to a multi-currency card?

Different card providers have their own fee structures. We’ll look at a few popular multi-currency cards in New Zealand, including their fees, in a moment. The costs to look out for include an exchange fee and a withdrawal fee – which we’ll cover next, as well as:

- Card order fee

- Card replacement or additional card fee

- Top up fee

- Cross border fee

- Account dormant fee

- Cash out fee

Not all fees apply to all cards – so it’s important to read the terms and conditions of your preferred card carefully so you know what to expect.

Whichever card you pick, you’ll also need to take steps to avoid the extra costs involved in dynamic currency conversion (DCC). This is where the merchant or an ATM asks if you’d prefer to pay in your home currency instead of the currency wherever you are. If you agree, the merchant or ATM picks the exchange rate used, which will often include extra fees which push up the cost. If you’re asked if you want to pay in dollars when you’re abroad, it’s best to say no to avoid extra fees.

Exchange fee

One crucial cost to understand is the exchange fee that applies when you convert currencies with your card. This fee may be clearly split out, or may simply be added into the exchange rate applied when you exchange currencies in your account, or spend a currency you don’t hold in your account. Generally looking for a card which uses the mid-market exchange rate with as low a fee as possible will mean you spend less in the end.

Withdrawal fee

Some card providers apply a fee on ATM withdrawals, which can vary depending on where in the world you are. The ATM operator might charge a fee too, so you’ll need to watch out for messages flashing up on the screen which should warn you before extra charges are applied. If they will be added, finding an alternative ATM may be a better bet.

Best multi currency cards: a comparison

Here’s a quick cost comparison of the cards we’ll look at in more detail next, so you can get a picture. Read on for more:

| Provider | Annual or order fee | Exchange rate | ATM withdrawal fee |

|---|---|---|---|

| Wise card | One time 14 NZD order fee

No annual fee |

Mid-market exchange rate | 2 withdrawals up to 350 NZD/month fee free

1.5 NZD + 1.75% after that |

| Revolut card | Fees depend on the plan you pick:

Standard plan customers have no monthly fee

Premium plan customers pay 9.99 NZD/month

Metal plan customers pay 19.99 NZD/month

|

Standard plan customers can convert 2,000 NZD/month with the mid-market rate – 0.5% fair usage fee after that

Premium and Ultra plan customers can exchange with the mid-market rate, with no upper limit

1% out of hours fee applies when converting outside market hours |

No ATM fee to plan limit, fair usage fees apply after that

Standard plan customers can withdraw 350 NZD/month with no fee

Premium plan customers can withdraw 700 NZD/month with no fee

Metal plan customers can withdraw 1,400 NZD/month with no fee |

| Travelex Travel Money Card | No order fee – top up charges may apply if you add money in NZD

2.95% fees for NZD spending

Inactivity fee of 4 NZD applies if you don’t use your card for 12 months

Cash out fees apply if there’s a balance when you close your account |

Travelex sets the exchange rate when topping up

4% cross border fee if you spend an unsupported currency, or a currency you don’t hold in your account |

No Travelex fee for overseas withdrawals

Local withdrawals have 2.95% fees |

| Mastercard Cash Passport | No order fee – top up charges may apply if you add money in NZD

|

Mastercard sets the exchange rate when topping up

5.95% cross border fee if you spend an unsupported currency, or a currency you don’t hold in your account |

Fee varies by currency – 4 NZD in New Zealand, for example |

| Air New Zealand Onesmart Card | No order fee

Monthly fee of 1 NZD |

Card network sets the exchange rate when topping up

2.5% cross border fee if you spend an unsupported currency, or a currency you don’t hold in your account |

3 free per month, then a fee applies which varies by currency – 3 NZD in New Zealand, for example |

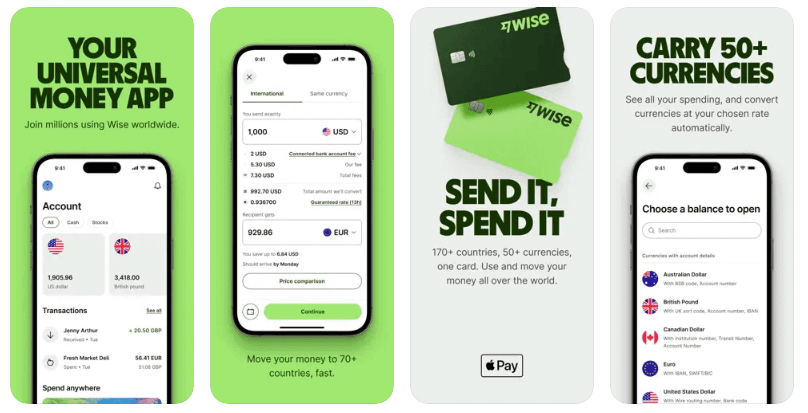

Wise card

Open a Wise Account online or in the Wise app with no account opening fee, to hold and exchange 40+ currencies. Whenever you convert currencies in the account or to make a card payment you’ll get the mid-market exchange rate, with low fees from 0.35%. You’ll be able to order your linked international debit card for a low one time fee of 14 NZD, to spend in 150+ countries. Wise accounts can be topped up in around 20 currencies, and also come with local bank details for up to 18 currencies so you can get paid by others conveniently.

Pros of the Wise card

- Easy to use in 150+ countries, with no ongoing card or account charges

- Hold and exchange 40+ currencies with the mid-market rate and low conversion fees

- Leave your funds in NZD and let the card convert at the point of payment if you like

Cons of the Wise card

- 14 NZD fee to get your physical card

- Some transaction fees apply

Revolut card

Revolut has 3 different account tiers for New Zealand personal customers. You can pick a Standard account which has no monthly fee, or upgrade to an account with a monthly charge to unlock more features and more no-fee transactions. All Revolut accounts come with a linked payment card, and can support 5 currencies for holding and exchange. Use your card for spending and withdrawals overseas easily – depending on your account tier you’ll get some no-fee ATM withdrawals every month, and some currency conversion which uses the mid-market exchange rate.

Pros of the Revolut card

- Choose from 3 different account plans, to suit your usage and spending patterns

- Hold and exchange 5 currencies, and get some no fee transactions monthly

- Unlock more features, including lounge access and priority support with higher tier accounts

Cons of the Revolut card

- Monthly fees apply to get full feature access

- Out of hours fees apply when you exchange funds when global exchange markets are closed

Travelex Money Card

The Travelex Money Card is issued on the Mastercard network for global acceptance, and can support 9 currencies for holding and exchange. There’s no separate fee to add money in a foreign currency, although an exchange rate markup may apply. Once you hold a currency in your account you can spend it with no Travelex fee, but a 4% cross border fee applies if you spend a currency you don’t hold already. Travelex cards are secure to use, and come with some extra cardholder perks as well as phone support if you ever have a problem.

Pros of the Travelex Money Card

- 9 supported currencies, with no separate fee to top up in a foreign currency

- No fee to get your card if you’re topping up in a foreign currency

- No Travelex fee applies when making ATM withdrawals

Cons of the Travelex Money Card

- 4% fee to spend a currency you don’t hold in your account

- 2.95% fee to spend or withdraw in NZD

Mastercard Cash Passport

With a Mastercard Cash Passport you can add any of 10 currencies, to spend and make withdrawals globally wherever Mastercard is accepted. You’ll be able to manage your card and account from the Mastercard app, and you could get access to exclusive experiences when you travel including free or discounted lounge access. It’s important to remember that there’s a 5.95% fee for spending a currency you don’t hold in your account, which can push up costs depending on where you travel.

Pros of the Mastercard Cash Passport

- 10 currencies available for holding and exchange

- Use globally wherever Mastercard is accepted

- Mastercard support services available 24/7, if your card is lost or stolen

Cons of the Mastercard Cash Passport

- 5.95% fee to spend a currency you don’t hold in your account

- Variable ATM fees apply depending on where in the world you are

Air New Zealand OneSmart Card

The Air New Zealand OneSmart Card supports 9 currencies, to spend and make withdrawals globally wherever Mastercard is accepted. You’ll earn Air New Zealand loyalty points as you spend with your card, which can be traded for travel rewards later. It’s free to get your card in the first place, and you can then manage your money from an app. Currency conversion fees of 2.5% apply if you’re spending a currency you don’t hold in your account, or if your balance isn’t enough to cover the cost of your transaction.

Pros of the Air New Zealand OneSmart Card

- 9 currencies available for holding and exchange

- No fee to get your card in the first place

- Several different ways to top up your account

Cons of the Air New Zealand OneSmart Card

- ATM fees apply when making a withdrawal

- Monthly fee of 1 NZD applies

Advantages of foreign currency cards

A multi-currency debit card from a non-bank service like Wise or Revolut is a good alternative to a bank card when you spend money abroad:

- You’ll be able to convert your money to the currency you need in advance to see your budget easily

- You’ll often get the mid-market exchange rate, or a preferential rate which can be better than the rate your bank sets

- You may be able to avoid foreign transaction fees and international ATM costs

- Your multi-currency card isn’t connected to your bank, adding an extra layer of security when you’re abroad

- You can manage your account from your phone with instant transaction notifications for security and convenience

Are there any limitations on the foreign currency card?

Multi-currency cards can have a few limitations. Here are some it’s worth knowing about:

- Deposits to your account may not be instant, depending on the card and how you choose to top up

- Debit cards aren’t usually accepted whenever a deposit is required – for example to hire a car or when checking into a hotel

- Top up, inactivity and closure fees may apply which push up costs overall

Conclusion: is the multi-currency card worth it?

Transacting internationally when you travel or when shopping online with overseas retailers can come with extra costs if you use your normal debit card. Foreign transaction fees may push up your spending – often by about 3%. Instead, a multi-currency card can help you get a better exchange rate, and also means you don’t need to carry too much cash when you travel – just use local ATMs on arrival as and when you need them.

Generally, multi-currency cards are easy to get, and come with low overall costs and fair exchange rates. Compare a few options using this handy guide, to help you decide which might suit you best.

FAQs

- What is an international debit card?

International debit cards, which are also commonly called multi-currency debit cards, are payment cards optimised for international transactions. They can make it cheaper – and improve security – when you shop and withdraw cash overseas. Check out services like Wise and Revolut as flexible, low cost travel card options.

- How to get a multi currency debit card?

Multi-currency cards from non-bank providers can usually be ordered online or through an app. In some cases, you can get a card from a physical location too. Check out Wise for an easy to order card if you don’t want to head out, or the Post Office, if you need to get a card instantly and can pop to a local branch to pick one up.

- How to use my debit card abroad?

Use your debit card abroad just as you would at home. Add money in advance, and your spending will be deducted from your balance instantly when you make a purchase or transaction. Your card will usually have contactless technology for convenience, too.

- What are the fees for a multi currency debit card?

Multi-currency card providers come with their own charges, which can include a card order fee, top up costs, currency exchange fees and account closure charges. Check out a few to see which might work best for your particular case, looking especially at exchange and ATM fees as these can push up costs if you pick a card which doesn’t suit your spending habits.