How does Wise work: Step-by-step guide 2025

Wise was launched as TransferWise in the UK in 2011, with the aim of making it cheaper, faster and more convenient to send money internationally. In 2021, TransferWise was renamed Wise to reflect the broader range of services on offer – including low cost international transfers, multi-currency accounts for individuals and businesses, and international debit cards.

If you’re considering making an international money transfer with Wise but have questions about how to use it, this guide is for you. We’ll walk through all the services and features Wise offers – and cover step by step how to send money or make the most of your Wise account.

Wise Key Points

- Create a free Wise account online or in the Wise app

- Send payments to 70 countries around the world

- Send directly to the recipient’s bank account (they don’t need their own Wise account)

- Fund Wise international payments using your online banking, pay by card, POLi or use a balance you hold in your Wise account

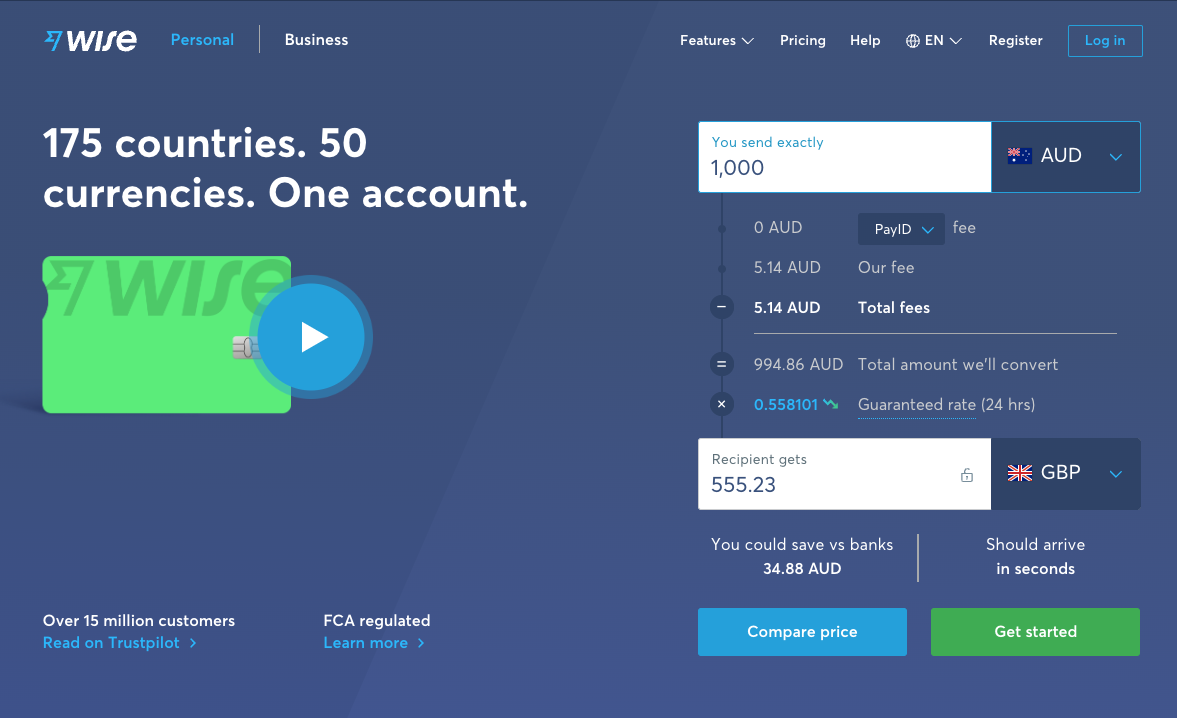

- All Wise currency exchange uses the mid-market exchange rate with a small transparent fee

- Hold 50+ currencies in the Wise multi-currency account, with your own local bank details for 10 currencies

- Get a Wise international debit card for easy spending and withdrawals all over the globe

- Business and personal account options available

What is Wise?

Wise is a financial technology company which specialises in international payments and flexible multi-currency accounts for individual and business customers.

You can use Wise to send a one off or recurring payment to 70 countries with the mid-market exchange rate and low, transparent fees – or choose to open a Wise multi-currency account to hold and exchange 50+ currencies all in the same place. Wise accounts offer a broad range of features to suit anyone living an international lifestyle – including an international debit card and local bank details to get paid fee free from 10 countries. (Wise review)

How does Wise work

You can open a Wise account online or in the Wise app for free, to get started sending payments overseas, and managing your money conveniently across currencies in the Wise multi-currency account. We’ll cover all you need to know about how to open a Wise personal or business account, including the verification steps required to keep your account safe, a little later.

Once you’ve registered your Wise account you can send money internationally and pay using your regular online banking service, a credit or debit card, or any balance you hold in your Wise account. Transfers are set up online or in the Wise app – and can move far faster than a normal international bank transfer. In fact, 50% of Wise transfers are instant, and 80%+ arrive within 24 hours.

Your funds will be deposited right into your recipient’s bank account for convenience. The individual or business you’re sending to won’t need to open a Wise account to get their money, and they’ll be notified when the funds are available for spending. Easy.

How does Wise make money?

Wise has a reputation for low cost international payments with transparent fees which beat the banks. But Wise is a business – so you might be wondering how exactly the company makes money from the services they provide.

Transparency is a core principle of the way Wise works – so you’ll always be able to see the fees you pay for any service you use, before you confirm the transaction. Wise makes money through charging a couple of fees when you send money:

- Fixed fee: covering the fixed costs associated with the transaction. No fees when making a bank transfer from NZD but there is usually a charge when the transfer is made with a debit or credit card.

- Variable fee: covering the cost of the currency exchange. For major currencies this is typically around 0.45% to 0.48% of the transfer value

The total average customer cost for Wise transfers can often be cheaper than using your bank, and often the lowest overall cost on the market.

Wise achieves this by taking a different approach to international transfers compared to traditional banks. While regular banks tend to rely on the 50+ year old SWIFT network to move money around the world, Wise built its own payment network and has accounts all over the world. This cuts out many of the inefficiencies of SWIFT and means that Wise payments are cheaper and more transparent compared to many bank transfers – and usually much faster too. Wise then passes on these savings to the customer – while still making money itself.

How to use Wise

Let’s take a look at how you can make the most of all the services and account features Wise offers – we’ll cover these in more detail in a full step by step guide in just a moment:

- Send Wise payments to 70 countries

- Hold 50+ currencies in your multi-currency account

- Convert currencies using the mid-market exchange rate

- Get a Wise international debit card for spending and withdrawals in 200+ countries

- Get paid like a local in 10 different currencies

- Open a business account to send, receive and exchange 50+ currencies

Wise personal account opening procedure

Wise has been created to offer an intuitive user experience with customers able to open a personal account on both the Wise Apple and Android apps, and the Wise desktop site. Here’s how:

- Download the Wise app or head to the Wise desktop site

- Register with your email, Facebook, Apple or Google ID

- Complete the verification step

- Top up your account, order an international debit card or set up your first transfer

How do I get verified on Wise?

To keep customers and their money safe, Wise has to complete a verification step when you open an account or set up an international payment. This is to comply with legislation around the world and prevent fraudulent or illegal account use – banks need to do this when customers set up accounts too.

However, while you might have to visit a branch to verify your bank account, the good news is that you’ll be able to complete the Wise account verification process entirely online or in the Wise app. Usually you’ll need to upload images of your ID and proof of address, and/or a selfie of you holding your ID. You’ll be guided through the process and can always save your progress and come back to it if you need to.

A valid ID can usually be:

- Passport

- National ID card

- New Zealand driver’s licence

- New Zealand firearms licence (if it includes a photo)

Valid proof of address documents include:

- Utility bills: gas, electric, or landline phone (no mobile phone bills)

- A bank or credit card statement (photo/scan of a physical letter or PDF of statement)

- A council tax bill, or a HMRC notification

- Vehicle registration or tax

- Photo driving licence showing your address and expiry date

- Any other government or financial institution-issued document

If you ever need any support while you’re completing the verification step, the Wise customer service team is on hand to advise you – by phone, online or in the Wise app.

How to open a Wise business account

Opening a business account is just as easy. Business accounts are perfect for entrepreneurs, freelancers and business owners who need to pay and get paid in foreign currencies. Here’s how to get your Wise business account in just a few simple steps:

- Download the Wise app or head to the Wise desktop site

- Register by adding details about your business, and yourself as the account holder

- Set up and pay for a transfer – if you’re opening a full Wise account you’ll also need to pay a one time fee

- Complete the verification step if required – you’ll be guided through this step if it’s needed

- You’re ready to go once the Wise team has verified your account

How do I verify my business on Wise?

Verifying your business account on Wise is entirely done online or in the Wise app. You’ll usually be asked to upload images of some key documents which can be used to verify both you and your business.

In most cases, as well as your business documentation which can vary based on entity type, customers looking to open a Wise business multi-currency account will need to provide the names, dates of birth, and countries of residence for any directors and shareholders who own 25% or more of the business.

If you’re not the director or a shareholder of the company, we’ll ask you to provide an authorisation letter, or a board resolution from the company, confirming that you’re authorised to use and communicate with Wise on behalf of the business.

The exact paperwork and information required will vary based on the type of business you’re running – you’ll be able to follow the on-screen instructions to check what’s relevant for you.

How to transfer money with Wise

Once you have a Wise account you’ll be able to send payments in 50+ currencies to 70 countries around the world. Whenever you need to switch between currencies you’ll get the real mid-market exchange rate with no markups and low, transparent fees. Here’s how to transfer money overseas with Wise:

- Log into your Wise account online or in the Wise app

- Select Send Money

- Enter the currencies you want to send to and from

- Confirm either the send amount, or the amount you want the recipient to get in the end

- Select the payment method – you can transfer money using your Wise balance, a bank card or right from your online banking

- Check over the fees and exchange rate, and confirm

- Follow the prompts to fund the payment and your money is on its way

Once your money is moving you’ll get an email notification, and you’ll also be able to track your payment in the Wise app or on the desktop site if you’d like to. Your recipient will be notified about the payment by email once it arrives

How to send money Wise to Wise

You can send a Wise transfer to a bank account – or you can choose to send a payment to another Wise account. That’s perfect if you’re sending a payment to a friend, splitting a bill or simply looking for the easiest possible way to make a transfer – without needing to know the recipient’s full bank details.

You can send money from your Wise account to another Wise account simply by using the recipient’s phone number – which makes it super easy to send to anyone already in your contacts:

- Open the Wise app

- Check you’ve opened a balance in the currency you want to send or receive

- Tap Recipients in your Wise app

- Select Find friends on Wise

- Choose the option to Sync contacts

- Select the contact you want to send to, and set up the transfer as usual

If you don’t have your recipient in your contact you can still send a payment – entering their email address is usually the easiest way. If they’re already on Wise you’ll be able to make the transfer directly, and if not, they’ll get a message prompting them to set up a Wise account so you can pay them.

Is Wise to Wise transfer free?

Wise to Wise transfers are free of charge when there’s no currency exchange involved. If you’re converting currencies, you’ll be able to make your payment with the real mid-market exchange rate and just Wise’s low, transparent conversion fee to pay.

How to deposit money in my Wise account

When you open your Wise multi-currency account you’ll be able to open currency balances in any of 10 different global currencies. That makes it easy to add money to your Wise account using your local bank details, or through the Wise app. First let’s look at how you deposit funds in Wise via the app:

- Select the currency account you’d like to add money to

- Click Add

- Enter the amount you want to add and the currency you’d like to pay with

- Select how you’d like to pay, and click Continue to payment

- Depending on how you’d like to pay, you’ll be guided through the payment steps

Alternatively you can use your local bank details for any of the 10 eligible currencies, to make a transfer right from your bank account into Wise. Just log into your online banking network and follow the steps to make a payment like you normally would. Don’t forget though, banks tend to be a very expensive way to convert currencies – so you’ll only want to use your online banking to top up Wise in the same currency as your account. Once you have a Wise balance you’ll be able to convert it instantly in the app with Wise’s great rates and low fees.

How to receive money with Wise

If someone is sending you a payment with Wise you can either receive it into your regular bank account, or choose to have it deposited into your Wise account using your local bank details, depending on the currency.

New Zealand-based Wise accounts come with the option of getting local bank details to receive payments in:

- British pounds

- Euros

- US dollars

- Australian dollars

- New Zealand dollars

- Singapore dollars

- Canadian dollars

- Romanian lei

- Hungarian forint

- Turkish lira

Whether you’re having a Wise payment sent to your normal bank account or deposited in your Wise multi-currency account you’ll just need to give the sender your account details, and the funds will be deposited as soon as they’re cleared. In many cases, you could have your money almost instantly.

What details do I need to give to the sender

Your sender will be able to confirm the details they need based on the way they’re setting up the transfer. However, usually, you’ll need to give them:

- Your full name as shown on your account

- Your account number or IBAN

If you’re having your money sent to a Wise currency balance other than NZD you might need to give slightly different details in addition – like a routing number and local bank address for USD transfers. All the details you need are available in the Wise app or by logging into your Wise account on the desktop site.

How to get a Wise debit card

Once you have a Wise multi-currency account you’ll be able to order a Wise debit card to make it easier to spend and withdraw money all over the world. Here’s what you’ll need to do:

- Log into the Wise app or desktop site

- Select Cards on the website or Android phones, or Account if you’re using an Apple device

- Follow the prompts to order your card, and pay a one time 14 NZD fee

- Your Wise debit card will be with you in 2 – 6 days. You can also choose express delivery for an extra charge to get your card within just a day or two

Once you’ve successfully ordered your Wise debit card you’ll be able to view your card details, and use your virtual Wise card for spending online. That means you’ll be able to get started before your physical card even arrives through the letterbox. Once your physical card does arrive you’ll need to activate it by making a chip and PIN purchase, or a withdrawal using your PIN at a regular ATM.

The Wise card is available for customers based in the UK, the US, Switzerland, Australia, New Zealand, Singapore, Malaysia, Japan, Canada, Brazil and most countries within the EEA.

How to withdraw money from Wise

Once you have a balance in Wise you can use your funds to send payments, spend with your Wise card, or withdraw your money to your bank account.

If you’re making a withdrawal from an ATM using your Wise card, you’ll be able to make up to 2 withdrawals, worth no more than 350 NZD, for no fee. After that, you’ll pay a low charge of 1.50 NZD + 1.75% of the withdrawal value for each withdrawal.

Sending money to someone else – or withdrawing money to your own bank account – may have a small fee depending on the currencies involved and how you set up the transfer. You’ll be able to see all your options – and any fees involved – by logging into the Wise app or desktop site.

Wise mobile app

The Wise mobile app is available for both Apple and Android phones. The Wise app is safe to use, with 2 factor authentication processes, and robust security. With the Wise app you’ll also be able to freeze and unfreeze your Wise card in just a tap, and check your balance in a glance. Instant transaction notifications will keep you up to date – and give peace of mind as you’ll be able to see everything that’s happening with your account in real time right from your phone.

How long does an international money transfer take with Wise?

Wise international transfers are fast. In fact, 50% of Wise transfers are instant, and the vast majority of payments arrive within 24 hours.

In contrast, sending money overseas with your bank can take 3 – 5 days depending on the destination country – and even longer if the currencies involved are less commonly used.

Who owns Wise?

Wise is a publicly traded company, listed on the London Stock Exchange.

Is Wise safe?

Yes. Wise is safe to use.

In the UK, Wise is regulated by the Financial Conduct Authority – much like your regular bank will be. And as an international company, Wise is also overseen and authorised by other regulators around the world, so you’ll know your money is safe no matter what currency you hold with Wise. In New Zealand Wise is supervised by the Department of Internal Affairs (DIA) for anti-money laundering purposes.

Wise also keeps customers and their money safe with manual and automatic processes like account verification, fraud detection and prevention protocols, and secure log in requirements.

Conclusion

Wise emerged over a decade ago with some pretty revolutionary ideas about how to make international transactions easier, cheaper and more transparent. Today 15+ million customers trust Wise to help them save money through Wise low cost international transfers and multi-currency accounts for individuals and businesses.

Using Wise is simple, and you’ll be able to access your account and all Wise services right from your laptop or smartphone. From setting up your account and getting verified, to sending your first payment, switching between currencies or withdrawing funds back to your normal bank, you can manage your money easily and cheaply, without even needing to leave home. Check out Wise low cost international payments and multi-currency accounts today to see just how much time and money you can save.

How does Wise work – FAQ

Do I need a bank account for Wise?

Wise accounts come with local bank details for 10 currencies which means it’s easy to manage your money across currencies – even if you don’t have a bank account in the currency you need.

Use your Wise bank details to get paid into your Wise account, to send transfers around the world or spend and withdraw with your Wise international debit card.

Can you deposit cash into a Wise account?

You can not deposit cash into a Wise account – you’ll need to add funds using a linked bank account or card, or have someone send you money using your Wise account details which are available in 10 different currencies.

What is the maximum you can send on Wise?

Wise maximum sending limits are set by currency – usually you can send the equivalent of up to around 2.2 million NZD. Log into Wise to check the sending limits for the currencies you need.

How long does it take to transfer with Wise?

50% of Wise transfers are instant, and 80%+ arrive within 24 hours. Banks, on the other hand, cam take 3 – 5 days to move money internationally.