4 Best (Travel) Cards without Foreign Transaction Fees in New Zealand

Foreign transaction fees can apply whenever you’re travelling and spend or withdraw in a foreign currency, or when you shop online with international retailers. These costs can significantly push up the price you pay for a vacation abroad, or for items being shipped to you from overseas – but you can avoid foreign transaction fees if you know how.

You’ll be able to cut out the tricky foreign transaction fees by using a travel optimised international debit, prepaid or credit card. Different options suit different preferences and needs – here we’ll cover 4 no foreign transaction fee cards including prepaid and credit options, and low cost alternative debit cards like the Wise card and the Revolut card.

Key points: Best cards with no foreign transaction fees

Wise debit card: Hold and spend 40+ currencies with a multi-currency debit card, with no ongoing fees and mid-market exchange rates

Revolut debit card: Various account tiers which all come with multi-currency options and a linked low cost debit card

Westpac Fee Free Mastercard Credit Card: Credit card with very few fees as long as you repay your bill in time and in full

Travelex Travel Money Prepaid Debit Card: Prepaid card with 9 supported currencies – no foreign transaction fee when you spend a currency you hold in your account

What is a foreign transaction fee?

You may pay a foreign transaction fee whenever you spend with your credit or debit card in a foreign currency. For cards issued by New Zealand banks, this fee is commonly 2% to 3%, although it can even be higher than this in some cases.

Foreign transaction fees apply when you spend or withdraw overseas, or if you’re shopping online with an overseas retailer. That means you could run into this fee even when you’re still at home – pushing up the costs of spending, often without you even realising it.

How do foreign transaction fees work?

Foreign transaction fees are added to the amount you pay when you use your card for foreign currency spending. If you’re using a debit card the fee is added to the amount deducted from your account, and with a credit card, the charge is added to the bill you pay at the end of the month.

How much are foreign transaction fees?

Where foreign transaction fees apply on a New Zealand card, they’re likely to be 2.5% – 3%. This percentage amount is added to every purchase and withdrawal, in addition to any other costs like a cash advance fee.

In this article, we’ll cover providers that do not have foreign transaction fees such as Wise and Revolut, as well as a couple of credit and prepaid cards with no foreign transaction fees.

4 Best international cards with no foreign transaction fees New Zealand

Let’s start off with an overview of the providers we’ll look at, based on their key fees and card type. We’ve picked out a variety of options here including different card types, so you can compare and decide if any suit your specific needs.

| Bank or provider | Name of the Card | Fees | Exchange Rates | Withdrawal fee |

|---|---|---|---|---|

| Wise | Wise Debit Card |

|

Mid-market exchange rate |

|

| Revolut | Revolut Debit Card | No fee to get a card, monthly fees of 0 – 19.99 NZD depending on account tier |

|

Some no fee withdrawals monthly based on account plan, then 2% fee |

| Travelex | Travelex Travel Money Prepaid Debit Card |

|

|

Travelex does not change an ATM fee |

| Westpac | Westpac Fee Free Mastercard Credit Card |

|

Network exchange rate | Westpac does not charge a cash advance fee |

As you can see, each card has its own features and fees – the best one for you will depend on how you want to spend, where you’re headed and whether you’re considering a debit, credit or prepaid card. It’s worth noting up front that the Travelex card may have foreign transaction fees if you spend in an unsupported currency, or if you don’t switch your balance to the currency you need in advance. This is worth looking at carefully to avoid surprise costs.

Here’s a quick summary of the no foreign transaction fees we’ve picked out and who they might suit best:

Wise debit card: Great if you want a low cost multi-currency debit card, with no ongoing fees and mid-market exchange rates

Revolut debit card: Great if you want to pick between different account tiers to get a debit card with the best balance of features and fees for your needs

Westpac Fee Free Mastercard Credit Card: Great if you want a credit card with more or less no fees as long as you repay your bill in time and in full

Travelex Travel Money Prepaid Debit Card: Great if you’d prefer a prepaid card you can pick up in a store, and you’ll be spending in one of the 9 supported currencies only

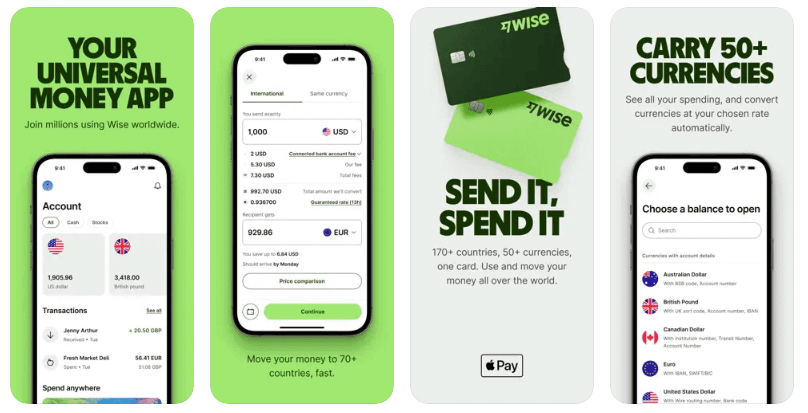

Wise Debit Card

Key point: Supports 40+ currencies for holding and exchange, with no foreign transaction fee and mid-market rates

You can open and manage your Wise account online or in the Wise app and order a debit card for spending in 150+ countries. You’ll get some free ATM withdrawals every month before the low Wise withdrawal fee begins, too.

Wise cards are linked to a powerful multi-currency account to hold and exchange 40+ currencies with no ongoing fees and no minimum balance. Wise currency exchange uses the mid-market exchange rate with low fees from 0.43%.

As a debit card there are no restrictive eligibility requirements, and you won’t need to worry about running up interest or penalties.

Foreign transaction fee: No foreign transaction fee

Annual or monthly fee: No annual or monthly fee

Currency conversion: Mid-market exchange rate

Benefits and rewards: no monthly fees, 40+ supported currencies, and ways to get paid in 9 currencies by local transfer

| Advantages of Wise Debit Card | Disadvantages of Wise Debit Card |

|---|---|

|

|

Revolut Debit Card

Key point: choose from varied plans to suit your spending habits, including some with no monthly fee, and some with ongoing charges and extra features – all come with a card for payments and withdrawals

Revolut has 3 different account plans for New Zealand customers, all with multi-currency holding options and linked debit cards for easy spending and withdrawals. You can either choose a plan with no ongoing fee, or trade up to an account with more features and monthly fees of up to 19.99 NZD if you’d prefer. There’s no fee to spend a currency you hold in your account, and all plans have some week day no fee currency conversion included.

Foreign transaction fee: No foreign transaction fee

Annual or monthly fee: Monthly fee of 0 – 19.99 NZD/month

Currency conversion: Mid-market exchange rate to plan limit, fair usage fees after that. 1% out of hours conversion fees apply

Benefits and rewards: Some no fee currency conversion and ATM withdrawals every month with all account plans, budgeting and savings tools also available

| Advantages of Revolut Debit Card | Disadvantages of Revolut Debit Card |

|---|---|

|

|

Travelex Travel Money Prepaid Debit Card

Key point: Hold 9 major currencies – no foreign transaction fee when you spend in a currency you hold in your account

The Travelex Travel Money Prepaid Debit Card can be collected in a store instantly if you’re in a hurry, and once you load the currency you need, there’s no foreign transaction fee. It’s important to note that this isn’t a full no foreign transaction fee option – there are still fees of 4% if you spend a currency you don’t hold in your account. However, it’s worth considering if you want a prepaid card option and you’ll be spending a major currency like AUD, GBP or EUR during your trip.

Foreign transaction fee: No foreign transaction fee when spending a currency you hold on your card

Annual or monthly fee: No annual or monthly fee – account dormancy fees apply if you don’t use your card

Currency conversion: Travelex exchange rate – if you’re spending a currency you don’t have on the card, there’s an extra 4% fee

Benefits and rewards: Hold 9 currencies, collect your card in person in a branch, no foreign transaction fee when spending a currency you hold in your account

| Advantages of Travelex Travel Money Prepaid Debit Card | Disadvantages of Travelex Travel Money Prepaid Debit Card |

|---|---|

|

|

Westpac Fee Free Mastercard Credit Card

Key point: Credit card with no standard or ongoing fees, including no foreign transaction fee – just watch out for interest, and repay monthly to get the best available deal

The Westpac Fee Free Mastercard is a credit card which has more or less no fees as long as you pay your bill in full and on time every time. If you don’t there’s interest to pay, as with any credit card – but if you’re looking for a credit card option with the possibility of low costs overseas, this could be a good pick.

Foreign transaction fee: No foreign transaction fee

Annual or monthly fee: No annual or monthly fee

Currency conversion: Network exchange rate

Benefits and rewards: No annual fee, no foreign transaction fee, relatively low interest

| Advantages of Westpac Fee Free Mastercard Credit Card | Disadvantages of Westpac Fee Free Mastercard Credit Card |

|---|---|

|

|

How to get a card with no foreign transaction fees in New Zealand

If you pick a no foreign transaction fee from a digital first provider like Wise or Revolut you’ll order and complete the verification process online. If you pick a bank or in person provider like Westpac or Travelex you may be able to apply online, or you might choose to visit a branch instead to show your ID.

Getting a card online or in an app is usually the easiest option. As an example, here’s how to get your Wise card in New Zealand:

- Open a Wise Account online or in the Wise app in just a few minutes

- Get verified by adding images of your ID and proof of address

- Top up your Wise Account in the currency of your choice

- Tap the Cards tab and order your Wise card for a one time fee

- Your physical card will arrive in the post – you can also start spending with your digital card right away

Learn more about how to get a Wise card here.

How to use cards internationally

International card payments are common in many countries in the world – and you’ll usually be able to find an ATM at an airport, or in larger towns and cities for when you need cash. Here are a few important points if you’re using your card overseas, to make sure the process is as cheap and hassle free as possible:

- Make sure your card will be accepted by the merchant or ATM – look for your card’s network logo (Visa or Mastercard for example)

- Check if your bank or card provider charges foreign transaction fees

- Always pay in the local currency to avoid extra fees incurred through dynamic currency conversion (more on that, next)

- Check if you have to let your bank or card provider know of your travel plans in advance for security reasons

- Clear your credit card bill as soon as possible to avoid interest and late payment fees

What is dynamic currency conversion?

We’ve mentioned Dynamic Currency Conversion (DCC) above – but what is that, exactly?

DCC is where you’re offered the choice to pay for your purchase or withdrawal using your home currency (NZD in this case) instead of the local currency wherever you are if you’re travelling overseas. It sounds harmless – and even potentially helpful as you can see what you’re spending in familiar terms instantly. However, it’s not that simple. If you agree to pay in NZD you’ll get the merchant’s exchange rate which may include extra fees, and is likely to mean you pay far more than you would if you let your card provider or bank do the conversion for you.

Cards like the Wise card and the Revolut card are smart enough to know what currency you need in any given country, and can simply convert for you at the point of payment if you like, often with no extra fees compared to converting in advance.

Which New Zealand banks do not charge foreign transaction fees?

Banks in New Zealand usually charge foreign transaction fees for their standard credit or debit cards. If you’re looking for a no foreign transaction fee card from a bank you may need to look out for a specialist product marketed as a travel money card, or a no fee credit card like the Westpac card we’ve highlighted in this guide.

Or, make life simple and order a no foreign transaction fee card from a provider like Wise or Revolut instead, for broad international functions and easy spending and withdrawals overseas.

Conclusion: Best card for overseas spending New Zealand

There’s not one single best card for overseas spending on the New Zealand market. Instead, there are different options from banks and non-bank alternatives, spanning debit, prepaid and credit card types – which means that picking the right one for you will take a little research.

Consider a non-bank multi-currency card and account from a provider like Wise or Revolut for a card with very good multi-currency options as well as no ongoing fees and great exchange rates whenever you spend and withdraw overseas.

Best card with no overseas transaction fees New Zealand FAQs

How do I avoid foreign transaction fees?

Avoid foreign transaction fees with a travel optimised card, like the travel debit cards from providers like Wise and Revolut. You may also choose a travel credit card or prepaid card – but do check what other fees may apply in these cases to make sure you get the best deal overall.

Which banks charge no foreign transaction fees?

Most New Zealand banks have foreign transaction fees unless you pick a specialist travel money card. For more flexibility with no foreign transaction fee to worry about you may be better off with a non-bank provider like Wise or Revolut for a flexible account with mid-market exchange rates.

Is it better to pay in local or foreign currency with my card when travelling?

If you’re offered the alternative to pay in your home currency or the local currency wherever you are, always pick the local currency in your location. This avoids extra fees which can be applied when you choose to pay in your home currency instead.

What is the most cost effective way to exchange currency?

There are different in person and digital currency exchange options, but specialist travel cards which let you hold the currency you need, and withdraw cash from ATMs in your destination can be a good way to cover all your bases.

Is it better to buy currency for the country you are visiting?

Buying currency in advance of travel gives peace of mind, but you won’t automatically get the best exchange rate if you’re switching dollars for local currency in cash at a money changing service. Another option is to get a no foreign transaction fee travel debit card from a provider like Wise or Revolut and use it to make cash withdrawals on arrival – this can mean you get a better rate compared to switching at home.

How do you avoid exchange rate fees?

Cut down on the fees involved in exchanging currencies by shopping around for a travel account and card with no foreign transaction fees and good exchange rates. Providers like Wise and Revolut can be a good place to start your research.