Wise Review: Fees, Rates and How it Works 2025

Our biggest, most comprehensive review at one of the most popular money transfer companies in the world, Wise money transfer.

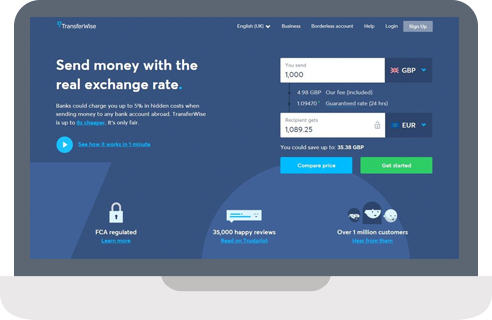

Wise (formerly known as TransferWise) offers low cost international transfers, multi-currency accounts for individuals and businesses, and currency conversion which uses the Google exchange rate.

If you’re wondering what Wise is all about, you’re in the right place. This guide covers the products and services Wise offers, what they cost, and how to get started. Let’s dive right in.

Wise: Key points

Key features:

- Price: No ongoing costs, no minimum balance - just low transaction fees for the services you use

- Exchange rate: Convert or spend with the Google exchange rate and a conversion fee from 0.41%

- Speed: 90% of payments arrive within 24 hours - 50% are instant

- Convenience: Check and manage your account online and in-app, and spend conveniently with your Wise debit card

- Transparency: No hidden costs, and you’ll always see how long your payment is likely to take before you confirm

- Security: Regulated by the Department of Internal Affairs in New Zealand

Key stats:

- 13+ million personal and business customers, in all but a small number of countries around the world

- 50%+ of Wise payments arrive instantly, 90% are there in 24 hours

- Wise accounts can hold and exchange 50+ currencies, and send to 80+ countries

- Spend with a Wise debit card in 170+ countries

- Wise accounts come with up to 10 local account details to get paid fee free from 30 countries

Overview

Wise is a likeable company. They are one of few companies that transparently offer you the interbank, or 'real' exchange rate. Which makes it easy to understand the way they are charging you. You do need to be comfortable doing everything online, as they have limited customer support.

Because of their fee structure, there is definitely money to be saved if you use Wise instead of your bank. Their Borderless Account also offers a new way to hold multiple currencies in one account and gives you the option to have international bank details. You can read more about it here.

Pros and cons of using Wise

- Intuitive and easy to use website and app

- Usually one of the fairest exchange rates out there, with transparent fees

- Pay by bank transfer or card, with transfers for individuals and businesses supported

- Multi-currency accounts make it easy to send, spend, hold and receive payments from all over the world

- Debit card comes with option to automatically convert your balance to the currency you need, so you never pay dynamic currency conversion charges

- No branch network for a face to face experience

- No cash or cheque payment options

- Some services you’d get from a bank aren’t available - no credit or overdrafts for example

What is Wise

Wise was launched in the UK in 2011, and now operates in all but a handful of countries around the world, helping over 13 million customers to send, receive, hold and exchange money. Wise is working on making it easier, cheaper and more convenient to send and receive transfers across borders, driving down prices and making fees and delivery times as transparent as possible for customers.

Wise launched as a money transfer service, but now has three focus areas. We’ll look at each in turn, next.

Wise money transfer

Send payments with Wise to bank accounts in 80+ countries. Arrange your transfer online or in the Wise app and pay by bank transfer, card or POLi. You’ll get currency exchange which uses the mid-market exchange rate and low fees from 0.41%. Wise payments are processed through Wise’s own payment network - which means they can be far faster than transfers made with your bank. 50%+ of Wise payments arrive instantly, and almost all are there on the same day.

Great for: individuals and businesses looking to send fast, secure international payments to bank accounts in 80+ countries

How much can I save with Wise?

Let’s start out with a price comparison for sending money with Wise versus some of our major New Zealand banks. We’ll look at which provider wins over a few different transaction values to give a flavour:

| Provider/payment | Wise | BNZ | ASB | Winner |

|---|---|---|---|---|

| 1,000 NZD to AUD - your recipient gets: | 938.05 AUD | 919.91 AUD | 910.14 AUD | Wise - your recipient gets up to 27.91 AUD more |

| 5,000 NZD to AUD - your recipient gets: | 4,691.73 AUD | 4,618.38 AUD | 4,606.52 AUD | Wise - your recipient gets up to 85.21 AUD more |

| 10,000 NZD to AUD - your recipient gets: | 9,385.30 AUD | 9,242.03 AUD | 9,228.33 AUD | Wise - your recipient gets up to 156.97 AUD more |

As you can see, in our example payments, your recipient got more with Wise compared to using the sample banks, across all 3 payment values. This is because Wise uses the mid-market exchange rate - the one you find on Google - and often has lower transfer fees than your regular bank, too. More on how Wise charges coming up later.

Wise fee calculator

How much Wise (formerly TransferWise) costs

Wise has disrupted the international transfer market with its fee structure. While banks often bundle their fees, adding an extra charge into the exchange rates they use, Wise splits out the fees you pay, so you can transparently check and compare costs.

Wise is working to bring down the costs of transacting over time, while operating on 3 key price principles:

- Be radically transparent

- Charge as little as possible

- Make premium the new normal

Because Wise is all about transparency, you can easily get a quote for a transfer, without even signing up for an account. You can just head to their homepage to get a quote and a delivery time estimate. There are even comparisons against other providers - if Wise isn’t the cheapest for your particular transfer, they’ll show that too.

Alternatively, you can use our exchange rate comparison engine. You can see Wise's exchange rates and compare them to the banks and other money transfer companies to see if they are the best option for you.

| Transfer Fee | Rates | Minimum transfer amount |

| A percentage of your transfer + a small fixed fee, based on the currency you're transferring. | Wise give you the best possible rate. They do not use a margin. | Not applicable. |

Wise exchange rate

Wise uses the mid-market rate without any hidden fees - the same rate you’ll find on Google or using a currency converter tool. This is different to many providers which add an extra fee, called a markup, to the exchange rate they use to process payments. Markups are often in the region of about 3% - which doesn’t sound like a lot, but which can mount up very quickly, particularly on higher value transfers.

Wise multi currency account and debit card fees

| Service | Wise fee |

| Open your multi-currency Wise Account | Free |

| Hold 50+ currencies | Free |

| Get local bank details for up to 10 currencies | Free |

| Order a Wise debit card | 14 NZD |

| Spend currencies you hold using your card | Free |

| First 2 ATM withdrawals up to 350 NZD/month | Free |

| ATM withdrawals over 350 NZD/month | 1.75% |

| Over 2 ATM withdrawals/month | 1.5 NZD/withdrawal |

| Convert a currency using your card | Low free from 0.41% |

| Receive money in EUR, GBP, AUD, NZD, RON, HUF, CAD, TRY & SGD | Free |

| Receive USD by ACH or bank debit | Free |

| Receive USD by wire | 4.14 USD |

| Send international payments | Low free from 0.41% |

Wise (TransferWise) Customer Reviews

Wise scores an Excellent 4.5 out of 5 on Trustpilot, which aggregates live customer feedback. At the time of writing, over 183,000 Wise customers have left Trustpilot reviews.

Happy customers tend to point to Wise’s ease of use, reliability and low fees. Where customers have left negative reviews, the issue is often that transfers have been delayed by extra verification checks. While this is frustrating, the chances are that the same would happen if sending a payment with a bank - most verification checks are as a result of financial legislation which applies to Wise, other money transfer services, and banks in the same way.

How to use Wise

While banks usually process international payments through the SWIFT network, Wise has built its own payment network which can cut the costs of international transfers, and get your money moving faster.

With SWIFT, banks pass a payment along a network of correspondent banks until it reaches its final destination. Each correspondent can charge a fee - which can mean your recipient gets less than they expected.

Wise works differently. When you want to make a Wise transfer, you send your money to Wise in dollars, to the local Wise New Zealand account. Wise then pays out the agreed amount from their account in the destination country. That means that no money really has to cross any borders - so no correspondents, no unnecessary delays, and no extra fees.

Funding methods

Pay for your Wise transfer by:

- Bank transfer

- Debit or credit card

- POLi

- Transfer from your Wise balance

![]()

Step 1: Register

Register your details through the Wise website. This will include the type of account you need, your details and the currencies you'll transfer. Once you provide some ID, Wise will let you know when your account is ready.

![]()

Step 2: Transfer

Once you have a quote for your transfer, you will go ahead and fill in the details of the person you're sending the money to. If you're sending it to your own international account, fill in your own details.

![]()

Step 3: Pay

Wise only accept payment by POLi pay, bank transfer and debit card. Wise also accept credit card for smaller transfers.

How to create an account with Wise

You can open a multi-currency Wise account entirely online or in the Wise app. Here’s how:

- Open the Wise homepage or app

- Click Register

- Follow the prompts to enter your personal details

- Get verified

- You’re ready to go

What documents you'll need

Just like when you open an account with your regular bank, Wise has to ask for documents to prove your identity. This is a legally required step to keep customers and their money safe. You can complete this verification step online or in the Wise app by uploading images of your documents, and save and return to the process later if you need to.

For a personal Wise account you’ll usually need to provide:

- Proof of your identity - like a passport or driving licence

- Proof of address - like a bank statement or utility bill in your name.

For a Wise business account you’ll normally need the above, plus:

- Business documentation which can vary based on entity type

- Names, date of birth, and country of residence for any directors and shareholders who own 25% or more of the business

How long does Wise take

Over 50% of Wise's international transfers are instant (delivered in less than 20 seconds), while 90% are delivered within 24 hours. You’ll see a delivery estimate before you start your payment, and you can track your money in the app if you need to.

Ultimately, the amount of time it takes for your Wise transfer to be processed will depend on the currencies and countries involved, how you pay, and any verification that’s required.

Supported Currencies

Wise supports 50 different currencies and lets you send to over 80 different countries.

Wise transfer limits

Wise transfer limits vary by currency. However, they’re usually set pretty high - at around the equivalent of 1 million GBP per payment.

Here are the Wise transfer limits for a few major currencies as an example:

| Sending | |

|---|---|

| NZD | 2 million NZD |

| EUR | 1.2 million EUR |

| USD | 1.6 million USD |

| AUD | 1.8 million AUD |

| CAD | No limit |

| SGD | 2 million SGD |

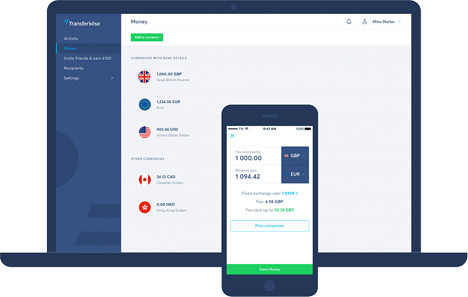

Wise multi currency account (Borderless) and card

The Wise account is a multi-currency account which lets you hold 50+ currencies, and also comes with local account details for up to 9 currencies covering major countries and regions like the US, UK, Eurozone, New Zealand, and Australia. Use your local account details to get paid fee free from 30+ countries, send payments to 80+ countries, and get a Wise debit card to spend and withdraw your way around 170+ countries, too.

Wise currency exchange uses the Google rate with no markup, which usually means you get the best available rate on the market, plus low conversion fees from 0.41%.

Great for: anyone who needs to receive, send, hold and exchange currencies, and spend with a linked international card.

To read our full review of the Borderless Account, click here.

To read more about the debit card, click here.

Does Wise have an App?

You can access Wise online or in the Wise app on Android and iOS. The Wise desktop site is available in 15 languages, with in chat support also offered across a broad range of languages.

Is Wise Safe and Legit?

Yes, Wise is a safe and legit company. Wise overseen by the Department of Internal Affairs in New Zealand, and as a global business, also regulated by authorities around the world.

There are many different manual and automatic processes in place to keep customers and their money safe, including 24/7 monitoring, 2 factor authentication and thorough account verification processes.

Wise Business Products

Business customers with Wise can send international payments, and open Wise business accounts, which have all the features available to personal customers - with a few extra business friendly perks added in. Business accounts come with batch payments which let you send money to up to 1,000 people at a time, and cloud accounting integrations to cut down on admin time. You can also add and manage user permissions to allow your accountant or team members to access your Wise account, and issue Wise expense and debit cards for international spending.

Great for: businesses, freelancers and entrepreneurs transacting internationally

Read about the Borderless Account account here.

Conclusion

Wise can offer low cost currency services - including multi-currency accounts, international debit cards, and transfers to 80+ countries - with lower overall fees and more flexibility than many banks can. In part that’s because Wise is a digital business without the overheads of a regular bank. But mainly it’s because Wise was built differently to banks, with its own payment network and a focus on offering transparent prices which come down over time.

Compare the service features and fees you can get with Wise to see if they can beat your regular bank.

Ready to go?

Wise money transfer review - FAQ

How much does Wise cost?

There’s no fee to open a Wise personal account, no ongoing fees, and no minimum balance. You just pay low, transparent fees for the services you use.

How long does Wise take to transfer funds?

Over 50% of Wise's international transfers are instant (delivered in less than 20 seconds), and 90% arrive within 24 hours.

Is Wise safe?

Yes. Wise overseen by the Department of Internal Affairs in New Zealand, and also regulated by a selection of authorities around the world.

How does Wise apply exchange rates?

Wise uses the Google exchange rate with no markup. You’ll only ever pay a low conversion fee from 0.41%, which is transparently shown when you arrange a payment.

Does Wise have a mobile app?

Yes - find the Wise app on iOS and Android.

How does Wise work?

Wise payments are made through the Wise payment network - which means they can move faster and be processed more cheaply than a bank SWIFT payment.

How many currencies does Wise support?

Hold and exchange 50+ currencies with a Wise account, send payments to 80+ countries, get paid like a local from 30+ countries, and spend in 170+ countries with a Wise card.